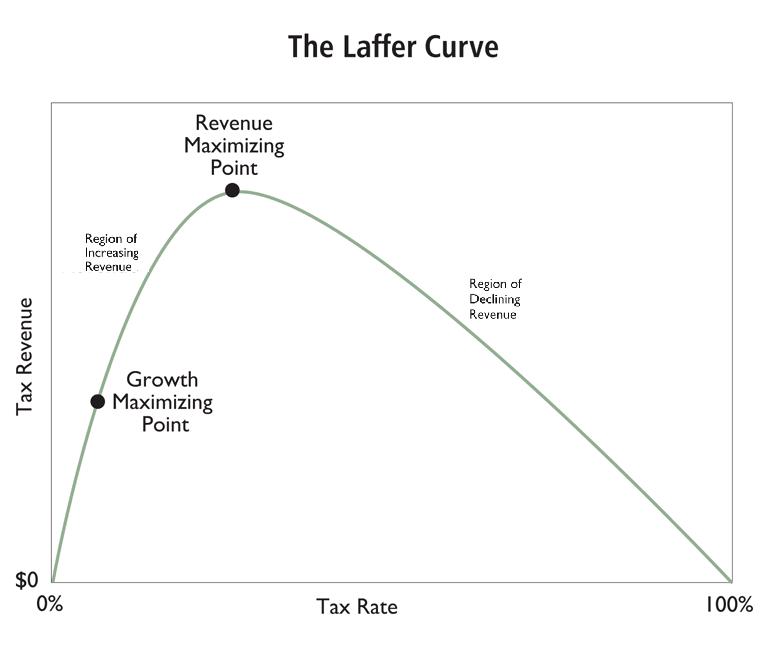

The Laffer Curve is lauded by conservatives for making the happy case that lower rates of taxation–to a certain optimal level–will generate more revenue for government than would be generated at higher rates. The logic is that reduced taxation incentivizes positive, growth-oriented economic activity, thereby creating larger pools of taxable private sector revenue.

Laffer’s famous theory—originally written on a cocktail napkin over dinner with Jude Wanniski, Donald Rumsfeld, and Dick Cheney—launched the “supply-side” economic philosophy that propelled the Reagan administration and continues to inform Republican economic policy to this day.

Yet, in his new book, Who Needs the Fed?: What Taylor Swift, Uber, and Robots Tell Us About Money, Credit, and Why We Should Abolish America’s Central Bank, ardent free marketeer John Tamny contends that the Laffer Curve ought to be consigned “to the proverbial dustbin of history.”

Why this seeming heresy? Tamny explains in the clip below:

Stated simply, rising tax revenues allow the barrier to productivity that is government to grow

[S]upply-siders often forget that all we gain from the federal government collecting more tax revenues is a bigger federal government. Indeed, the size of the federal government grew in the 1980s, and it continues to grow. Congress has power over the federal purse, so when revenues surge, so does government spending.

So while supply-siders (and for that matter all economists, politicians, and pundits) should focus on reducing the tax burden, they should also emphasize reducing the amount of revenues taken in by the federal government. Politicians exist to spend, so when the federal government collects abundant revenues, something quite contrary to supply-side philosophy reveals itself. There is more consumption of the economy’s wealth through excessive spending by Paul Ryan, Nancy Pelosi, Harry Reid, and Mitch McConnell. Stated simply, rising tax revenues allow the barrier to productivity that is government to grow. More broadly, Americans as a whole despise Congress, yet surging tax revenues empower Congress to spend with abandon the wealth that citizens have created.

…In modern times, and alongside an increasingly flush federal government, Washington, D.C., has become rather fancy. When politicians talk up “stimulus” spending, it is realistically code for a redistribution of the economy’s resources by a political leviathan that is being enriched on the backs of the American people. That’s what’s on the surface, what I’ll call “the seen.”

The “unseen,” however, is all the cancer cures, transportation innovations, and software advances that aren’t being invested in because Washington consumes so much of the wealth we create. When supply-siders extol empirically true revenue increases that result from reductions in the rate of taxation, they’re imposing massive new taxes on the American people. Those revenues increase the tax that is government spending, whereby Congress allocates huge portions of the credit created by the private sector; these taxes are growing by leaps and bounds with each increase in federal revenues.

…[A]s top Kennedy advisor Walter Heller explained (and it was as if revenue-obsessed supply-siders were whispering to him as early as the 1960s), economy-boosting tax cuts generate “a better economic setting for financing a more generous program of federal expenditures.” Supply-side has unwittingly paired aspects of itself with government-expanding Keynesianism.

The late Nobel Laureate Milton Friedman…was quite correct in asserting that when tax cuts lead to higher federal revenues, taxes haven’t been cut enough. The Laffer curve, which correctly asserts that a lower rate of taxation leads to greater growth and higher federal revenues, is a tautological reality, as the 1920s, 1960s, and 1980s make plain.

At the same time, it’s well past time to consign the Laffer curve to the proverbial dustbin of history. While the fiscal focus should always and everywhere be on reducing the tax burden, it should be on reducing it so much that revenues actually decline. If they don’t, then stringent rules must be put in place to ensure that the revenues are returned to the taxpayers, used to pay off any existing federal debt, and so on. If these revenues are handed to politicians, the singular result is more economy-sapping federal spending that grows and grows. Odds are Arthur Laffer would agree with this. As the next chapter will explain, government can’t be a good investor or allocator of the economy’s abundant credit. It can only waste it.

In that case supply-siders must rewrite a portion of their otherwise correct message. Government is a barrier to production, and its waste enriches the political class, all the while destroying limited credit that would otherwise fund huge economic advances. Higher federal revenues represent a hideous bug in the supply-side tax-cutting argument, not a feature.

It’s time to cut taxes to a rate that actually pushes revenues well below the Laffer curve.

For more from John Tamny read Who Needs the Fed?: What Taylor Swift, Uber, and Robots Tell Us About Money, Credit, and Why We Should Abolish America’s Central Bank and be sure to listen to our complete interview below.